Correlation Between Interest Rate And Stock Prices: What Are those?

Interest rates are a key factor for stock prices. They can positively or negatively affect the performance of the market, depending on their level and direction. This piece will explain what interest rate is, how it affects our economy and why it matters for our stock market. It will also look at what factors determine them and how they correlate with each other over time

What Is Interest Rate?

The interest rate is the price of money. It’s how much you have to pay for borrowing money, including both the principal and any additional charges that may be associated with it. The concept of the interest rate can be tricky if you’re new to it, but once you understand what it means and how it affects your finances, you’ll be able to better manage your finances so they don’t get out of hand because of an unexpected expense or unexpected financial burden.

What Are The Factors Determining Interest Rates?

Before looking at the relationship between interest rates and stock markets, let us examine the factors that determine these rates. Keep in mind that interest rate is a key factor in determining the price of stocks. It can affect a company’s earnings, but it also affects its stock price.

The interest rate is determined by the Federal Reserve Bank in the United States and other central banks around the world. Central banks set this rate based on their assessments of economic conditions as well as inflationary pressures or deflationary ones.

When there are strong economic growth periods with low unemployment rates, central banks may increase their target interest rates so that they stay within their target range for inflationary or deflationary situations respectively; when there are weak economic conditions such as recession or high unemployment rates then these same central banks will lower these same targets for inflationary or deflationary reasons respectively.

Why Does The Interest Rate Matter For Our Stock Market?

The interest rate is the price of money, capital, and debt. It’s also known as the cost of borrowing or the cost of lending.

The interest rate affects how much you pay for your bonds when you buy them from a broker, which in turn affects how much money you have to invest and what stocks or other investments you can buy with that money. This is because bond prices reflect changes in bond yields: If investors think future growth will be slow (or nonexistent), they’ll demand higher returns than if they think growth will be strong (and thus demand lower returns).

How Is The Correlation Between Interest Rate And Stock Price?

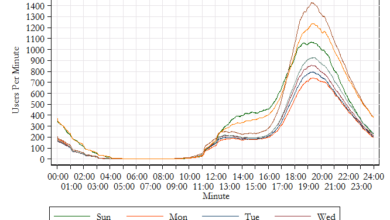

You may be wondering how the correlation between interest rate and stock price can be so high. The answer is that it’s not a direct relationship. In fact, if you take a look at the history of these two variables, you’ll notice that they have been correlated for many years but only recently have their correlations reached an extremely high level. The reason why this happens is that stocks represent ownership in companies (or “equity”), which are typically valued based on earnings per share (EPS).

Higher EPS means more money earned by shareholders—and therefore greater returns on investment for them. As such, when there’s good news about company earnings or profitability potential—like when sales increase due to increased demand for products or services offered by those businesses—this increases confidence among investors who then begin buying more shares in those companies like the Dow Jones Industrials Average.

That said, the interest rate is one of the most important factors that affect stock prices. The higher the interest rates, the lower will be your stock prices. However, there are other factors that can also affect this relationship. Remember interest rates and stock prices have a strong negative correlation. This means that when the interest rate is low, investors are more likely to put their money in stocks than when the interest rate is high.