Tips And Tricks To Use The Best Forex Brokers For Beginners

Forex trading is a complicated business that is not for the faint of heart. However, we will always help our readers to trade smarter. Check out our tips and tricks to use the best forex brokers for beginners.

There are a number of factors that influence our selection of the best forex brokers for beginners. We need the best trading software, execution times, and – most importantly – access to an educational system to learn how to trade. However, there are several other elements that you should consider when you are selecting your next forex broker.

Every new forex trader experiences the same worry about which forex broker is best for them. The reason for this worry is that there are so many forex brokers out there and you want to be sure you choose the right one.

Finding a good quality Forex broker is one of the most difficult tasks for beginners. In fact, it can even be frustrating – no matter if you are starting out with Forex or are already a trader. Finding the right Forex broker can not only save you money but also increase your trading knowledge, skills and performance significantly. The right Forex broker will allow you to grow as a trader, so choosing the right one is crucial!

Best tips for newbies in forex trading

Most people don’t know how to enter into Forex trading, as it requires lots of knowledge and experience. It not only needed to be professional but also need to have knowledge about different aspects of the Forex market. Basically, Forex is a currency exchange process in which one currency will be exchanged for another. There are certain factors that should be kept in mind before entering into Forex trading. There are some tips for newbies in forex trading that can help them to earn profit and avoid loss.

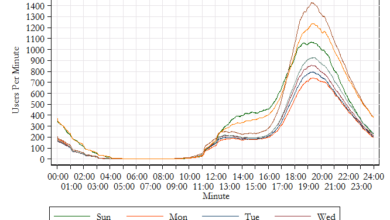

Forex Market is always changing, so there are very few chances to succeed in this field by following the same tricks again and again. New traders should keep an eye on the changes that take place in the market. They must follow the latest trends and move according to them.

Some currency pairs are easy to predict; these are known as major currency pairs. These pairs are Euros with USD, USD with JPY, GBP with USD, etc. These pairs can be predicted easily; however, they come with low-profit rates.

Strategies for beginner trades

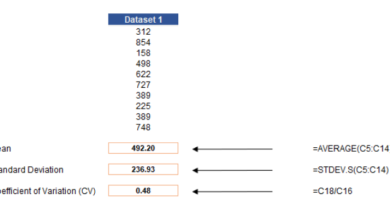

For any beginner trader starting to learn how to trade the stock market, it is imperative that they first identify their risk tolerance and capital allocation. There are two main questions to ask yourself when determining your capital allocation: 1) How much money can you afford to lose? and 2) How much wealth do you want trading to generate for you?

Next, you need to determine what type of investor you are. Are you a passive investor, who wants to invest in strong companies and hold them for the long term, or an active investor that wants to trade stocks frequently based on their price movements? If you are an active investor and want to learn how to day trade or swing trade stocks successfully, then read on.

The best way for a beginner trader to approach the stock market is with a simple step-by-step strategy that can be put into place without too much thought or analysis. I have found that there are certain setups in the market that tend to work very well as they have shown their value over time.

Different Things To Look For In A Forex Broker

There are several different things that you want to look for when you are trying to find the best forex broker. Each forex broker will offer you a different trading platform, so it is important to understand how each one operates before you begin trading with them.

You will also want to research the company to make sure that they are legitimate and that they have not had any problems with the law in the past. There are some great resources on the internet where you can learn about the companies yourself, but it’s always a good idea to speak to someone who has used them before.

Another thing that is important to consider when finding a good broker is whether or not they charge a fee for using their service. If they do, it is usually very minimal, and you can usually receive your money back if they don’t deliver as promised.

The third thing that is important when looking for a broker is how much money they will allow you to deposit into your account. This is something that varies from one company to another, and from one individual to another. You should always be sure that you know what your maximum amount of money is before signing up with a broker so that you don’t get stuck with an account balance below what you expected.

The successful track record of the ” Traders Union” has recently been recognized by the leading international finance experts. The reputation of the company has grown to be one of the best in the online trading industry. This has been made possible by the hard work and dedication of our experienced professionals who have combined their efforts to provide high-quality trading services for every member of the “Traders Union”. We continue to strive to achieve new heights in terms of customer satisfaction and financial stability.